The Weekly Squeeze

The Squeeze covers all things digital assets; crypto, macro, finance, and the latest juice on the street.

At a Glance:

US debt limit deal passes at the last minute before deadline.

Nvidia rallies, briefly surpassing a $1T market cap.

Autopilot’s ChatGPT-powered trading service gains traction with 25,000 investors.

Coinbase CEO says china's crypto crackdown could hurt US innovation.

Ethereum scaling protocol, Optimism token prices drop ahead of unlock, doubling token supply.

High Impact Events:

Markets sighed a breath of relief as the US passed a debt limit deal in last minute efforts to avoid default before the June 5th deadline.

In the significant bipartisan move, the House voted to suspend the debt ceiling until 2025. The agreement reflected a collaborative effort to avert a potential financial crisis and ensure the stability of US finance by suspending the $31.4T limit on federal borrowing until January 2025.

In the upcoming week, global markets have their eye on the economic calendar with the following highlights:

Friday, June 2nd: The EU will hand down YoY inflation rate, expected at 6.5% and unemployment rate, which is also forcasted at 6.5%. In the US, ISM manufacturing, unemployment rate, and non farm payrolls will be released.

Tuesday, June 6th: The Australian RBA will release its interest rate decision which is expected at 3.85%.

Wednesday, June 7th: China, Canada, and the US will all hand down Balance of Trade data and Australia will release QoQ GDP growth rate.

Thursday, June 8th: Australia is planned to release Balance of Trade data.

The Squeeze:

May appeared to be a challenging month in markets and macroeconomics alike. Layoffs were seen from Microsoft, LinkedIn, Nansen, and the latest from JP Morgan who was set to cut additional jobs this week, including roles in technology and operations. Discussion of the debt ceiling x-date, rising rates, and strained housing markets weighed on sentiment and overall confidence in the current market regime.

Meanwhile, in the background, conversations of AI continued to bubble and microchip company, Nvidia, pushed above $1T market cap for a brief window, momentarily joining the greats of Google, Amazon, Apple, and Microsoft, if only for a moment in time.

The S&P traded flat in May, gaining 0.25%, while the Nasdaq traded 5.80% higher on the month. In some of the largest inflows since 2020, tech stocks pressed to the upside with Google lifting 14%, Meta gaining 10%, Apple adding 5%, Microsoft gaining 7%, and of course the latest Nvidia, which pressed 40% higher.

It seemed that optimism surrounding the debt ceiling resolution that came mid-week was enough to bolster sentiment and drive valuations higher. Perhaps sophisticated market participants were well positioned to front-run the doom and gloom headlines that retail were quick to sell into. Was the adage ‘sell in May and go away’ not the case this year?

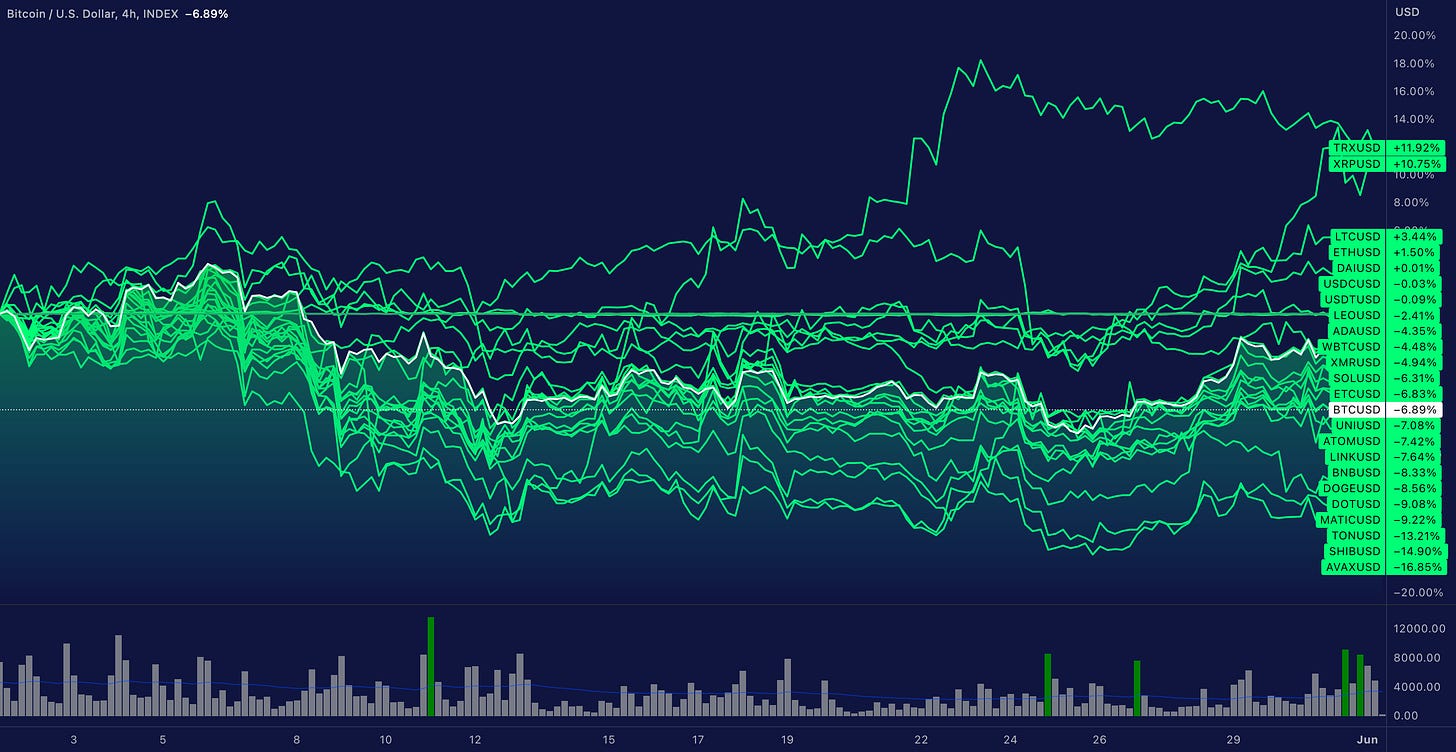

For the digital asset majors, Bitcoin closed the month of May 6.94% lower and Ether managed to close the month 0.20% higher. Bitcoin dominance by market capitalization slipped 1.61% in May, leaving the digital asset major at 47.89% dominant by market cap.

Total crypto market cap closed 5.24% lower in May, leaving $1.10T in the crypto markets.

The recent period of low volatility and narrow trading ranges in the crypto market suggested that equilibriums will likely create a shift in market dynamics and a break of range. The coming weeks of June will be important to determine the trajectory of the digital asset space and its performance relative to other assets in the global marketplace.

Lastly, to the volatility traders out there watching the tape and derivatives activity, the top liquidations occurred on May 8th where $197.5M longs were liquidated, and on May 28th where $108.7M shorts were liquidated across all exchanges.

Key Events and News:

Nvidia's Market Cap Tops $1 Trillion on Strong AI Demand.

Nvidia briefly joined the ranks of companies with a market caps exceeding $1T this month, as demand for AI continued to trend.

Nvidia's year-to-date gain of over 180% was supported by demand for their graphics processing units (GPUs), which power generative AI tools.

While some may view Nvidia's recent market performance as a sign of an overheated market akin to the dotcom bubble, analysts suggest that there is still ample room for growth in the AI market.

Leading artificial intelligence computing company, Nvidia, briefly joined the ranks of companies with a market capitalization exceeding $1T, supported by demand for AI technology. On May 30th, Nvidia's shares reached a high of over $418 which brought the AI darling’s market cap to $1T before retreating by the end of the day.

In the US, only four companies trade in excess of the $1T cap, including Apple, Microsoft, Amazon, and Google. Nvidia’s YTD gains exceed 180% thanks to the explosion in AI interest and overall demand for GPUs which power AI tools. It is estimated that over 80% of GPUs are currently manufactured by Nvidia.

While some may view Nvidia's recent market performance as a sign of an overheated market, the AI boom is believed to be in its early stages, and Nvidia is well-positioned to capitalize on the continued expansion

ChatGPT Trading Service Boasts 25,000 investors.

25,000 investors have signed up to trade alongside ChatGPT.

After two weeks, the portfolio is up around 2%, tracking on par with the stock market.

While robust and resourceful, AI tools and chatbots lack the human touch necessary to interpret market nuances and trends accurately.

Over 25,000 investors have signed up for The GPT Portfolio experiment from copy trading firm Autopilot. Traders have allocated nearly $16M on the AI-powered stock picker, hoping to take a small slice of the back-tested 500% return in academic research.

Each week the GPT Portfolio gets the AI to analyze 10,000 news articles and 100 company reports to select 20 stocks for the $50,000 portfolio. Initial favourites included Berkshire Hathaway, Amazon, D.R. Horton and Davita Health. After only two weeks, the portfolio has performed on-par with the stock market, up around 2%.

It's worth being careful using AI for trading, however. Crypto derivatives platform Bitget recently abandoned its experiment of using AI on the platform due to the potential for misinformation. A survey of its users found 80% of users had a negative experience with the AI, including false investment advice and other misinformation.

Gracy Chen, Bitget’s Managing Director commented that "AI tools, while robust and resourceful, lack the human touch necessary to interpret market nuances and trends accurately."

Is it entirely obvious for us to note that investors should do their own research before investing any money in AI-powered trading services?

Coinbase CEO Says China's Warming to Crypto Could Hurt US Innovation.

Coinbase CEO, Brian Armstrong, expressed concerns that restrictive crypto regulations in the United States could drive innovation offshore.

China is promoting digital systems like Alipay and Tencent payment systems to challenge the global dominance of the U.S. dollar in commerce.

Brian Armstrong, the CEO of Coinbase, expressed in an editorial published by MarketWatch that China stands to benefit from the "restrictive" crypto regulations in the United States, which inadvertently drive innovation to offshore locations. Armstrong emphasized that China, an ambitious adversary, is promoting digital systems like Alipay and Tencent payment systems to challenge the global dominance of the U.S. dollar in commerce, especially with the recent launch of the digital yuan.

Armstrong pointed out that it is no surprise that Hong Kong is positioning itself as a new crypto hub. Speculation about China warming up to the sector arose after state broadcaster China Central Television featured the Bitcoin logo in a segment about cryptocurrencies. Reports indicate that although China prohibited the use of cryptocurrencies in 2021, it released a web3 white paper to support the industry's development earlier this month.

Bitcoin Mining Difficulty Surpasses 50 trillion Mark, Miners Adapt to the Challenge.

Bitcoin mining difficulty surpassed 50 trillion for the first time on May 31, 2023.

The difficulty level reached an unprecedented 51.23 trillion.

Leading mining pool, Foundry USA, contributed the most hashrate to the network on May 31.

Bitcoin achieved a significant milestone on Wednesday as its mining difficulty rose by 3.4% at block height 792,288, setting a new record. This development marks the first time in Bitcoin's history that the difficulty level has surpassed the 50 trillion mark, reaching an unprecedented 51.23 trillion.

The data reveals that approximately 373 exahash per second (EH/s) of hashrate is dedicated to the Bitcoin blockchain, showcasing the network's consistent growth. With an all-time high of 491.15 EH/s recorded on May 2 at block 787,895, the escalating hashrate and faster block intervals led to a 3.22% increase in difficulty on May 18 at block height 790,272.

The latest difficulty adjustment, resulting in the 51.23 trillion difficulty level, reflects the growing challenge of discovering a BTC block. Miners now require increased computational power and resources to find a valid hash and secure mining rewards. Despite this heightened difficulty, bitcoin miners remain undeterred, and the network's overall hashrate continues to remain steady, demonstrating a consistent trend of activity.

Leading mining pool, Foundry USA, contributed the most hashrate to the network on May 31, with 114.75 EH/s, followed by Antpool (79.75 EH/s), F2pool (55.34 EH/s), Binance Pool (34.99 EH/s), and Viabtc (29.30 EH/s). The network's average hashrate stood at approximately 366 EH/s over the last 2,016 blocks. The next difficulty adjustment is scheduled around June 14, 2023.

Optimism Token Prices Drop Ahead of Unlock, Doubling Token Supply.

Optimism, an Ethereum scaling protocol, plans to release tokens worth over $587 million, resulting in a 7% decline in OP token prices.

The unlock signifies the end of the initial vesting period, doubling the circulating supply of the tokens from 335 million to a significant number.

The unlock presents challenges as early investors may opt to take profits, leading to increased selling pressure.

Optimism, an Ethereum scaling protocol, is scheduled to release tokens worth over $587 million into the market as part of its unlock plan. This development has caused a 7% decline in the prices of OP tokens. The unlock marks the end of the initial vesting period for early investors and contributors, resulting in an almost doubling of the circulating supply of the tokens.

When tokens are unlocked, holders gain the ability to sell or swap them. Currently, more than 386 million optimism tokens are held by early contributors and investors. With this unlock, OP's circulating supply, which currently stands at 335 million tokens, is expected to increase significantly.

The unlock poses a potential challenge, as early investors who have already accumulated substantial gains may choose to take profits, leading to increased selling pressure. It remains to be seen if these early investors, including a16z and Paradigm, will flood the market with these newly unlocked tokens

Disclaimer: The information and opinions provided in this newsletter are for general information and research purposes only and should not be construed as financial advice or investment advice. Squishy Capital is not a financial adviser and does not provide financial advice of any kind. The information contained in this newsletter is not recommendation to buy or sell any financial instrument, asset, or tradable product. Squishy Capital accepts no liability for any loss or damage arising from the use of, or reliance on, the information provided in this newsletter. By subscribing to this newsletter, you agree that you will not hold the publisher or any of its affiliates liable for any losses or damages that you may incur as a result of relying on the information contained herein.